The right payroll system lets you efficiently tackle all of your payroll activities, including timekeeping, wage calculation, withholding, payroll accounting, and payroll tax reporting. The wrong payroll system is laborious and leads to payroll mistakes. It is important to evaluate the payroll system you’re currently using and decide whether it’s right for your business or if another payroll system might optimize your payroll process.

Related articles:

How Using Payroll Software is an Advantage for Your Company

Payroll Management: Processes and Solutions

On-Premises Payroll System

Do you have more than 25 employees? Is it financially feasible for you to maintain an on-site payroll team? If so, you may select an on-premises payroll system, which means that the software is installed and stored on an in-house server.

This payroll system option simplifies payroll management — because the entire process is computerized — and enables you to rely on a dedicated in-house team. For best results, the payroll system should be integrated into your HRIS, so that information flows seamlessly from human resources (HR) to payroll. On the downside, an on-premises payroll system can take a toll on your finances. You not only have to compensate an entire payroll and HR team, but also have to pay for the server hardware as well as in-house IT support.

Often, it is more effective to outsource your payroll and HR needs to a professional in this case.

Cloud-Based Payroll System

Also called Software-as-a-Service (SaaS), cloud-based HR and payroll systems can be used by employers of all sizes, although studies have shown that they are currently being used mostly by smaller businesses. A 2017 report by ISG Insights reveals that more than half of all employers will use cloud-based or hybrid solutions for human resources purposes by 2020, more than twice the amount that currently do.

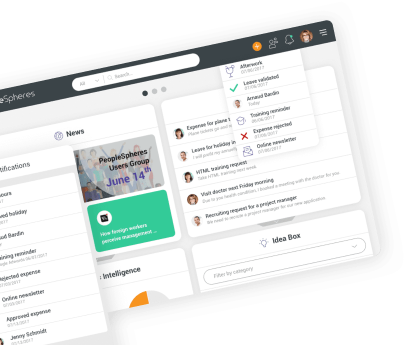

A cloud-based payroll system is housed in the cloud, or over the Internet, at the vendor’s data center rather than on the business’ in-house server. Employers are flocking to the cloud because of its cost-effectiveness and scalability. For example, no software needs to be installed and the SaaS vendor provides IT support. These payroll systems also have integrative capabilities that combine HR and payroll functions into a unified solution, which streamlines the HR and payroll process while reducing administrative errors.

Do you know which payroll system best for your company?

The answer depends on your size and the complexity of your HR situation. Many companies want to focus on their area of expertise, and choose to use a professional payroll service provider. With the right payroll system, however, you could see your company really take off.

Choosing the right payroll system involves several important steps. First, assess your business needs, including the number of employees and specific payroll features required, like tax compliance and benefits management.

It’s also crucial to consider the scalability of the payroll system as your business grows. Look for a system with a user-friendly interface and reliable customer support. Don’t forget to read reviews and possibly request a demo to see how the system works in practice.

Ultimately, the goal is to find a system that simplifies your payroll process, reduces errors, and saves time.

-360x360.jpg)